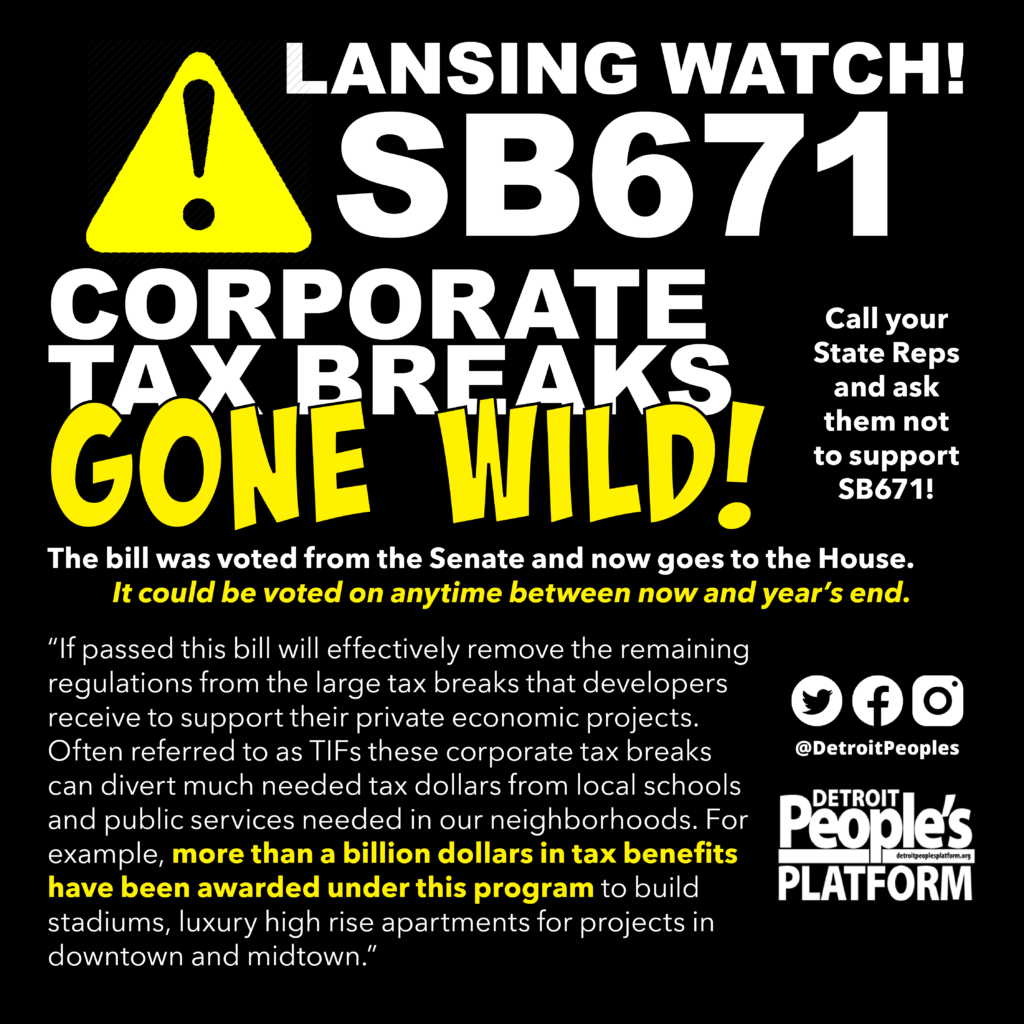

Corporate TAX Breaks

Gone Wild!

The bill was voted from the Senate and now goes to the House.

It could be voted on anytime between now and year’s end.

“If passed this bill will effectively remove the remaining regulations from the large tax breaks that developers receive to support their private economic projects. Often referred to as TIFs these corporate tax breaks can divert much needed tax dollars from local schools and public services needed in our neighborhoods. For example, more than a billion dollars in tax benefits have been awarded under this program to build stadiums, luxury high rise apartments for projects in downtown and midtown.”

Call your State Reps and ask them NOT to support SB671!

Aiyash, Abraham (Democrat) District-4 Room 1289 House Office Building +1 (517) 373-1008 abrahamaiyash@house.mi.gov

Carter, Tyrone (Democrat) District-6 Room 1289 House Office Building +1 (517) 373-0823 TyroneCarter@house.mi.gov

Cavanagh, Mary (Democrat) District-10 Room 1289 House Office Building

+1 (517) 373-0857 marycavanagh@house.mi.gov

Johnson, Cynthia (Democrat) District-5 Room 1289 House Office Building

+1 (517) 373-0844 CynthiaAJohnson@house.mi.gov

Scott, Helena (Democrat) District-7 Room 1289 House Office Building +1 (517) 373-2276 helenascott@house.mi.gov

Tate, Joe (Democrat) District-2 Room 1289 House Office Building +1 (517) 373-1776 JoeTate@house.mi.gov

Thanedar, Shri (Democrat) District-3 Room 1289 House Office Building +1 (517) 373-0144 ShriThanedar@house.mi.gov

Whitsett, Karen (Democrat) District-9 Room 1289 House Office Building

+1 (517) 373-6990 KarenWhitsett@house.mi.gov

Yancey, Tenisha (Democrat) District-1 Room 1289 House Office Building

+1 (517) 373-0154 tenishayancey@house.mi.gov

Young, Stephanie (Democrat) District-8 Room 1289 House Office Building

+1 (517) 373-3815 stephanieyoung@house.mi.gov